- Sectors

- Solutions

- Developers

- Contact Us

- Blog

- Login

Sector

Fintech

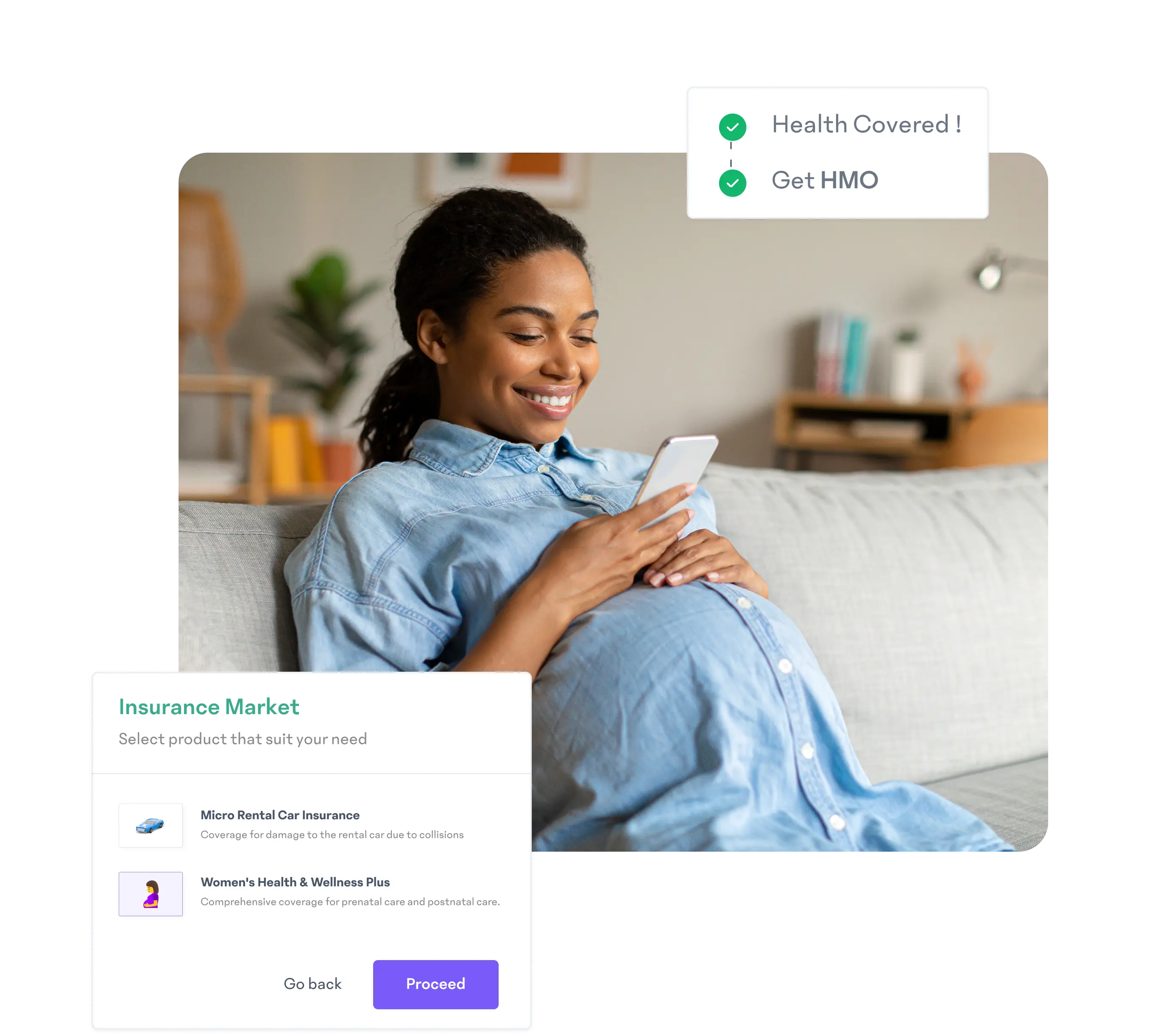

It’s About Finance, Include Insurance

Increase service offerings, user engagement and grow revenue by giving your customers access to an array of insurance products from multiple insurance providers.

Embedded Insurance Solutions for Comprehensive Financial Services

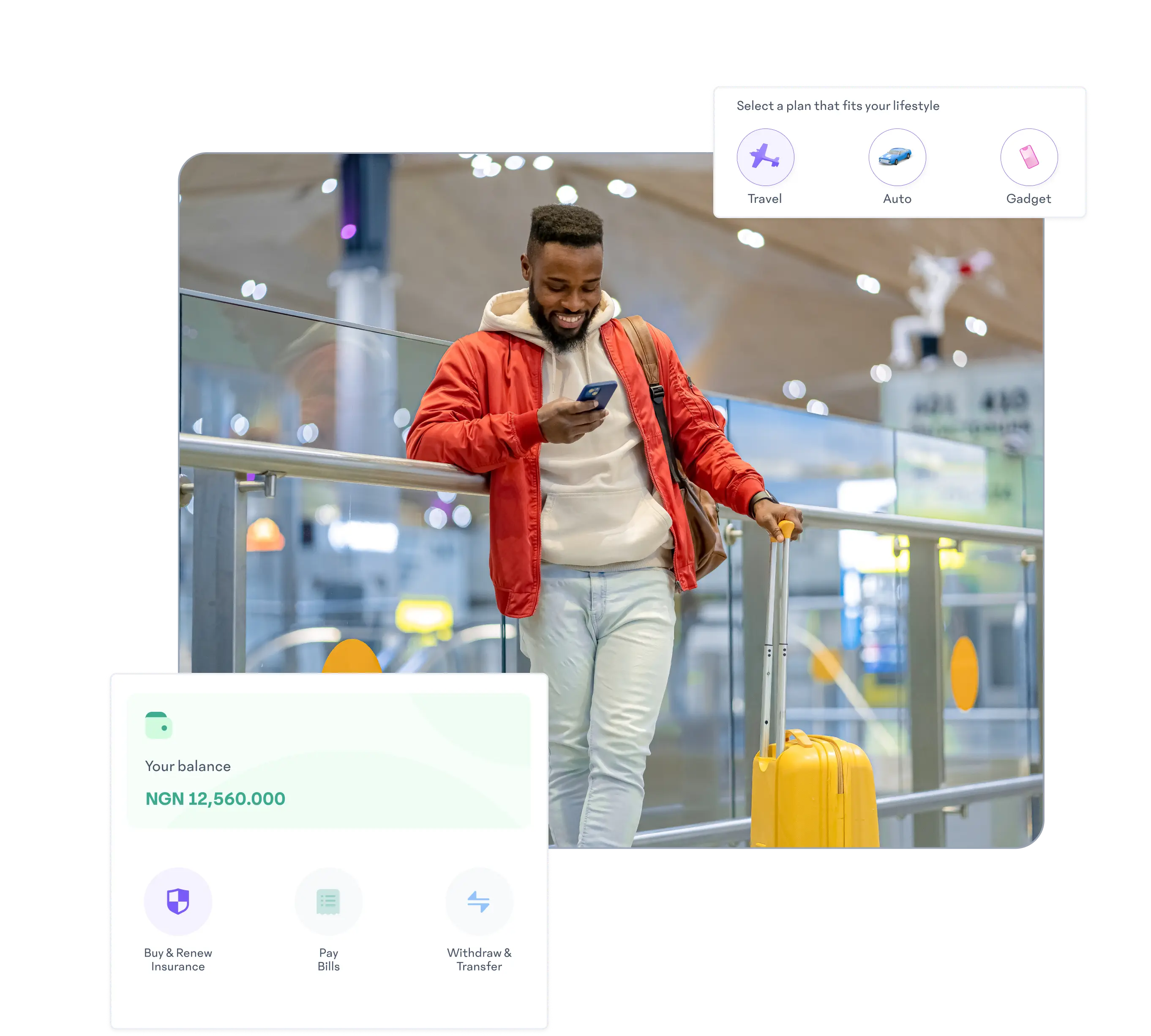

Embed Insurance Solutions into Your Services

Embed lifestyle insurance solutions into your app, that cater to your users’ needs, offering products like; Health, PAC, Auto, Gadget, Travel, Life Insurance and more.

Insurance Solutions for Niche Markets

Co-create custom built insurance products that serve a niche market and offer unique solutions to your unique audience.

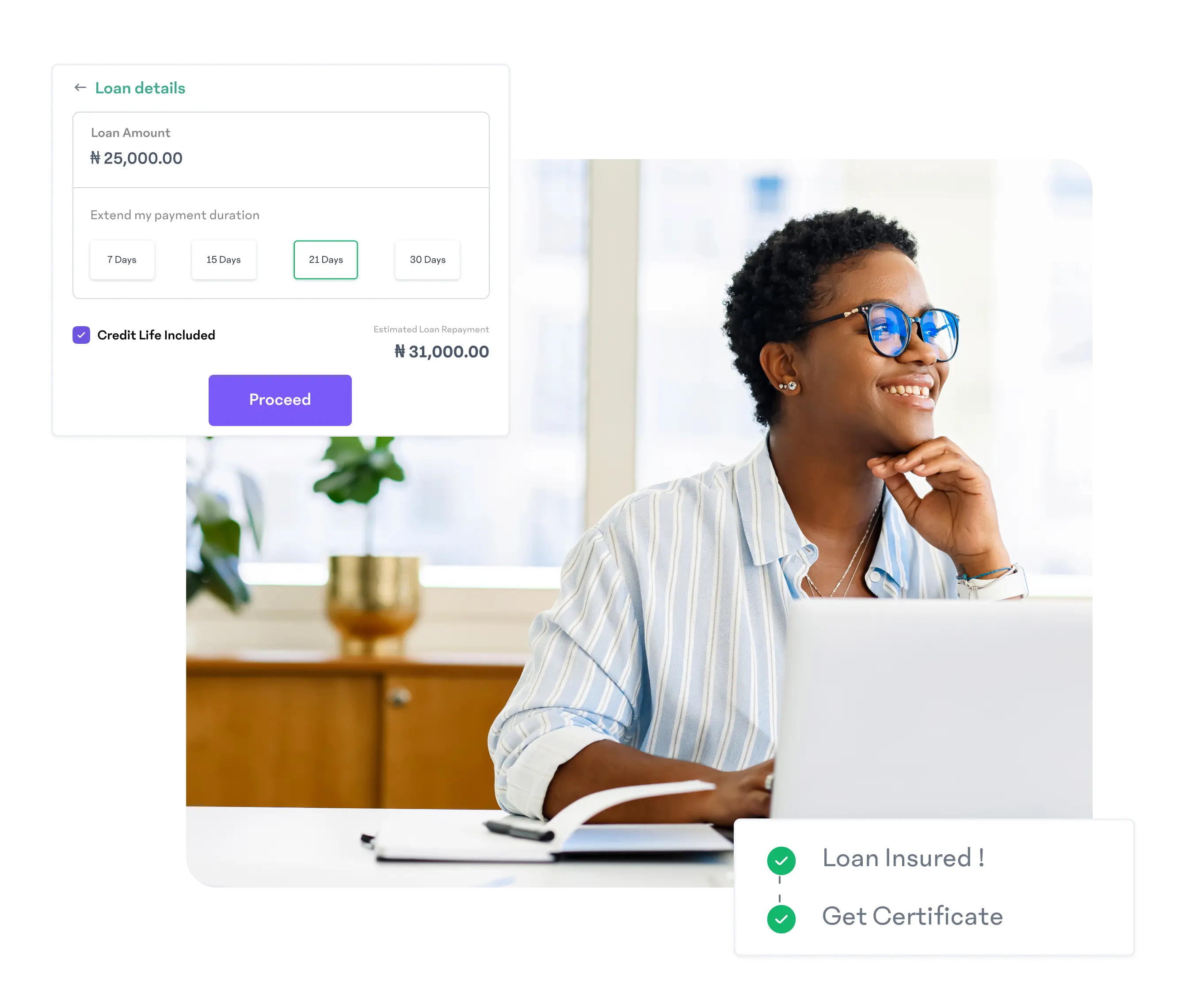

Insurance on Loan Defaults

Build a sustainable business by mitigating financial loss that occurs through defaults on loan services. Embed credit life insurance per loan to protect your business against bad debts.

Everything You Need to Offer Comprehensive Financial Services

Multiple Insurance Providers

Discover an array of insurance products spanning across multiple sectors with the option to collaboratively create your own customised products.

Top Insurance Providers

With our centralised platform, we give you direct access to leading insurance providers. Say goodbye to the hassle of managing multiple partnerships, integrations, and compliance requirements.

Seamless API & SDK Integration

Seamlessly integrate our API and SDK to achieve a good experience from purchase, to renewals to claims processing. Our API & SDK ensures that you don’t build out the entire customer journey so you get to focus on your core business.

Fast & Automated Claims

Enjoy comprehensive support through every step of the insurance process. Tech Support | Policy Purchase | Policy Management | Claims Processing

End-to-End Support

Enjoy comprehensive support through every step of the insurance process. Tech Support | Policy Purchase | Policy Management | Claims Processing

Extra Revenue For Your Business

Improve your value prop to your customer and create an additional revenue source for your business; earn commissions on all insurance purchases for your customer.

Comprehensive answers to some commonly asked questions

Are you an Insurance Company?

Mycover.ai is not an insurance company. We partner with insurance companies to co-create and provide embedded insurance for businesses through our open insurance API and infrastructure.

How will I handle claims?

We've eliminated the hassle of handling complex operations with an automated claims management system. Your consumers also enjoy the simplicity of rapid claim assessments and payouts, with access to support.

Do I need to have an online platform?

MyCover.ai is designed for anyone, with or without a digital platform. You can sell and earn directly from your dashboard.

Do I need a license?

We provide direct access to multiple insurance providers without the need for complicated legal structures, integrations, or compliance.

Join us in building the rails that will power the future of insurance in Africa.

Developed in partnership with top African insurance companies.

SECTORS

COMPANY

© 2024 MyCover.ai. All Rights Reserved.

Nigeria

MyCover.ai is not an insurance Company. We partner with leading and licensed insurance companies in Nigeria to co-create and deliver innovative products tailored to our customers. As a technology company, we leverage technology to make insurance affordable, transparent and accessible to Africans.